Smarter affordability, better outcomes

Improve coverage and increase responsible lending with our frictionless and explainable Affordability Engine designed specifically for embedded and digital lending.

Increase responsible lending

Grow your loan book with more proportionate assessments

Promote financial inclusion

Increase your addressable market and accelerate loan portfolio growth

Maximise

conversion

Increase coverage and improve the checkout experience

The time to act is now: FCA Financial Lives Survey

A total of 19,145 respondents completed the FCA’s Financial Lives Survey (2022) to compare how UK adults’ product holdings, finances and experiences have changed over the previous five year period.

The report highlights the financial pressures facing UK consumers and the need for innovation to enable the credit market to support those under increasing financial pressure.

77% (40.9m) of UK adults felt that the burden of keeping up with their domestic bills and credit commitments had increased

70% (37.1m) had seen their financial situations worsen

71% (36.9m) either had no disposable income (15%) or had seen their disposable income decrease (56%)

29% (15.3m) had seen their unsecured debt increase

Introducing our Affordability Engine

Explainable and accurate affordability assessments are more important than ever. With our Affordability Engine, you can harness a explainable, stable, and innovative model for more accurate, cost effective and proportionate decisions to complement your current approach.

Other affordability solutions

Incomplete picture of an individual’s income and non-discretionary expenditure

Inaccurate processes leading to compliance risk

Challenges to categorisation accuracy and conversion drop off with Open Banking

Delays that can damage customer experience

Infact’s Affordability Engine

Predicted essential and non-essential expenditure

Model can factor in application amount, payments and any other known repayments

Leverages historical declared income, expenditure and Open Finance verified data

Suggested and adjustable thresholds for affordability assessments

scenario

Other affordability assessments don’t cut it

Traditional approaches to assessing affordability are incomplete and add friction to the consumer journey. To automate affordability, lenders are forced to rely on self-declared income, Open Banking, Current Account Turnover Data (CATO) and ONS expenditure estimates. Our Affordability Engine can be a standalone service but also helps you make the most of your existing affordability tools.

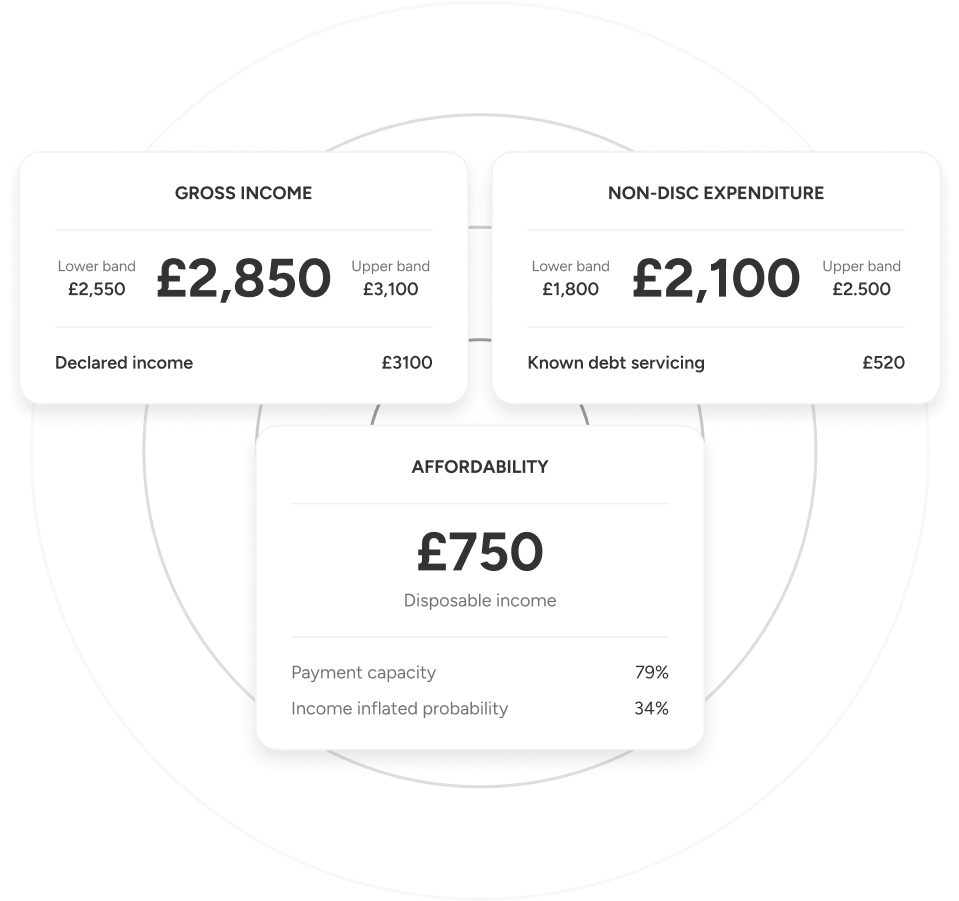

establishing a baseline prediction

Predicted Income and Expenditure

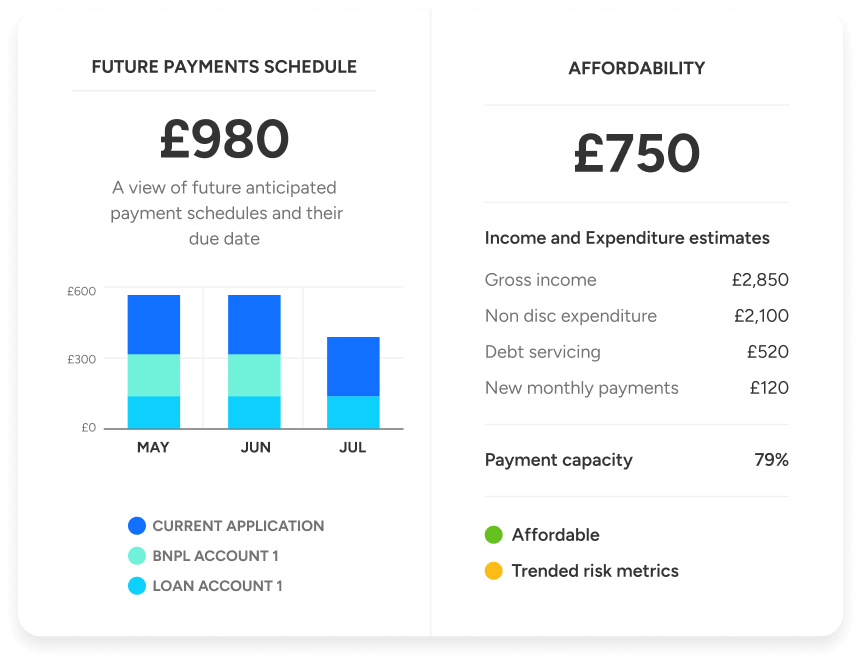

With our Affordability Engine, you can personalise a prediction to make more accurate, cost effective and proportionate decisions. Our affordability features reduce friction in originations journey and in life management.

The future of affordability

Creating a more personalised view of affordability

Our unique ability to incorporate an application amount, payments and other credit payments into our prediction enables us to build a more personalised, timely picture of affordability.

Built for digital and embedded lending

Improve customer experience, avoid missed opportunity

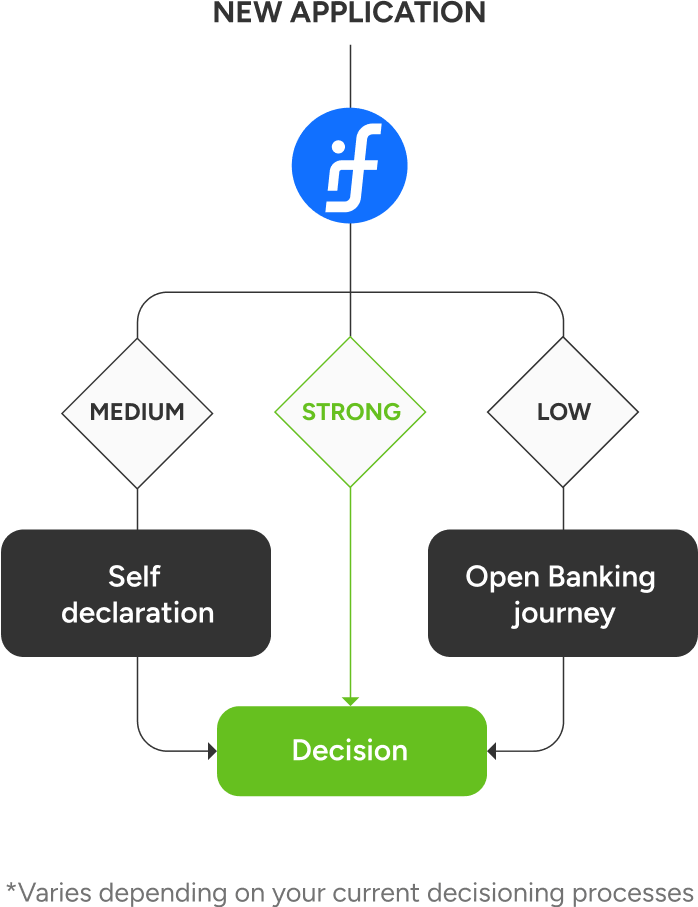

Improve conversion rates and increase responsible lending with our Affordability Engine triaging customers at the top of funnel without introducing additional friction. Identify low-risk individuals while also streamlining the identification of higher-risk individuals for more thorough affordability assessments.

Where we can help

Proof of

value analysis

Assess potential performance uplift and calibrate thresholds so you can start with a more effective scorecard.

Collaborative approach to building scorecards

We collaboratively support conversion and risk optimization through exploratory data analysis to aid your decision-making.

Co-innovate

with us

Join us in co-innovation to enhance your lending performance with our collaborative, personable team.

Improving the entire customer lifecycle

Learn how Affordability Engine can help you gain a clearer picture on a consumers creditworthiness.

use case

Originations

Streamline your origination process with our affordability solution to boost conversions and promote responsible lending to more non-prime individuals.

use case

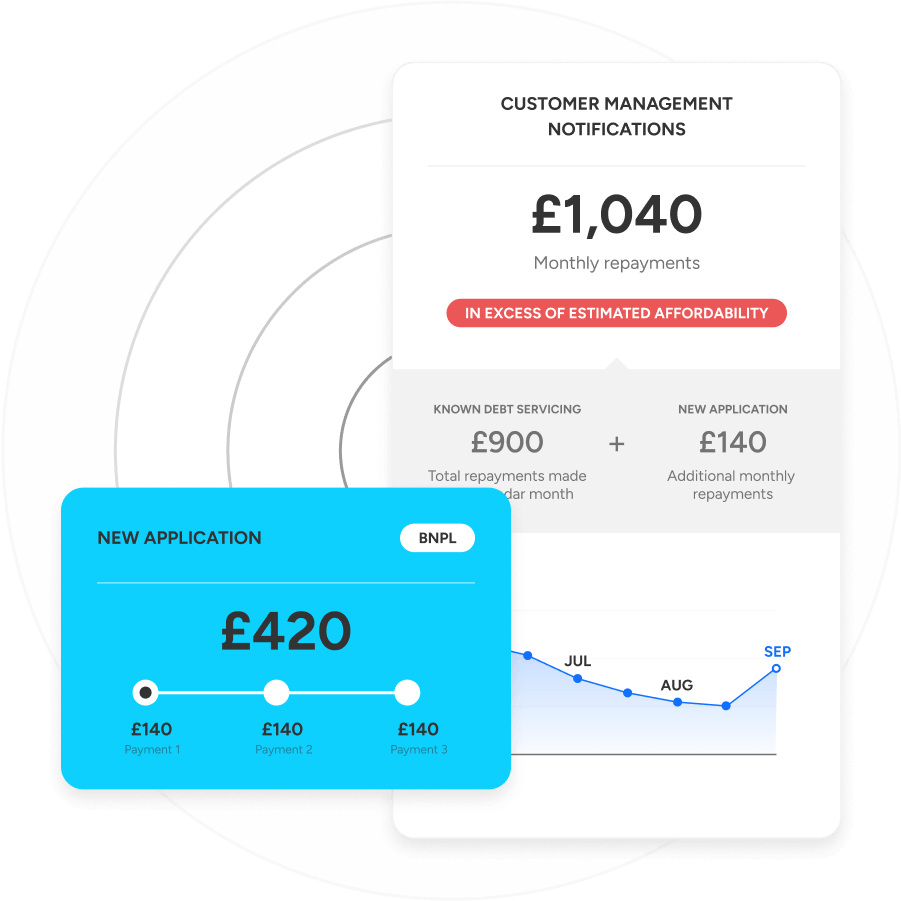

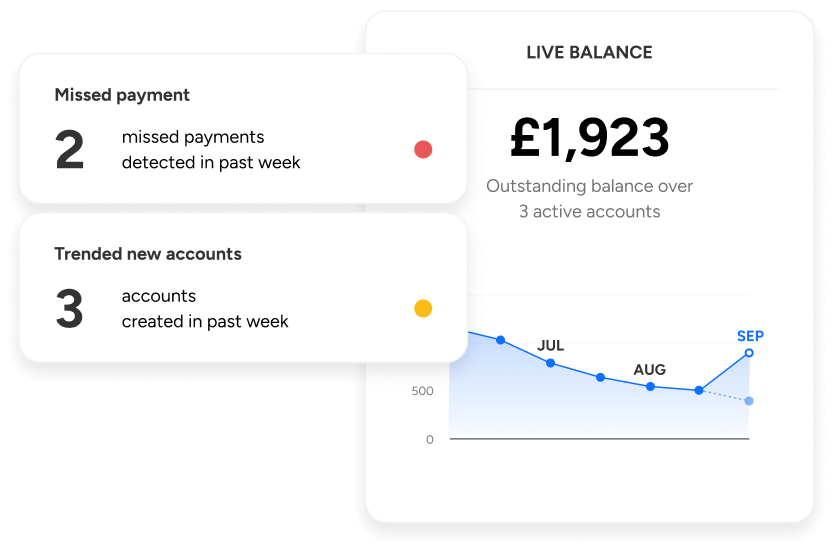

Customer management

Continually monitor your customers and identify new lending opportunities in your portfolio with our seamless affordability and event-driven notifications.

Real-time data for modern credit

Join us on our mission to innovate in the UK credit information market and take the next step in exploring our next-generation solutions for consumer credit decisioning.

Developer portal

Request access to our API documentation and Quick Start guides.

Speak to sales

Explore how our innovative products can help with our team of experts.

Follow our journey

Stay up to date with our progress as we disrupt the UK credit information market.